At Outbuilders, we know that financing a tiny home can be a challenge. Many people wonder, “Can you finance a tiny home?” The answer is yes, but it’s not always straightforward.

In this post, we’ll explore various financing options for your dream tiny home, from traditional mortgages to creative solutions like crowdfunding.

How Can You Finance a Tiny Home?

Traditional Mortgages: Not Always the Answer

Financing a tiny home presents unique challenges. Most banks don’t offer conventional mortgages for tiny homes due to their size. The National Association of Home Builders reports that the average tiny home is about 400 square feet, which falls below the minimum square footage many lenders require for a traditional mortgage.

RV Loans: A Popular Choice for Mobile Tiny Homes

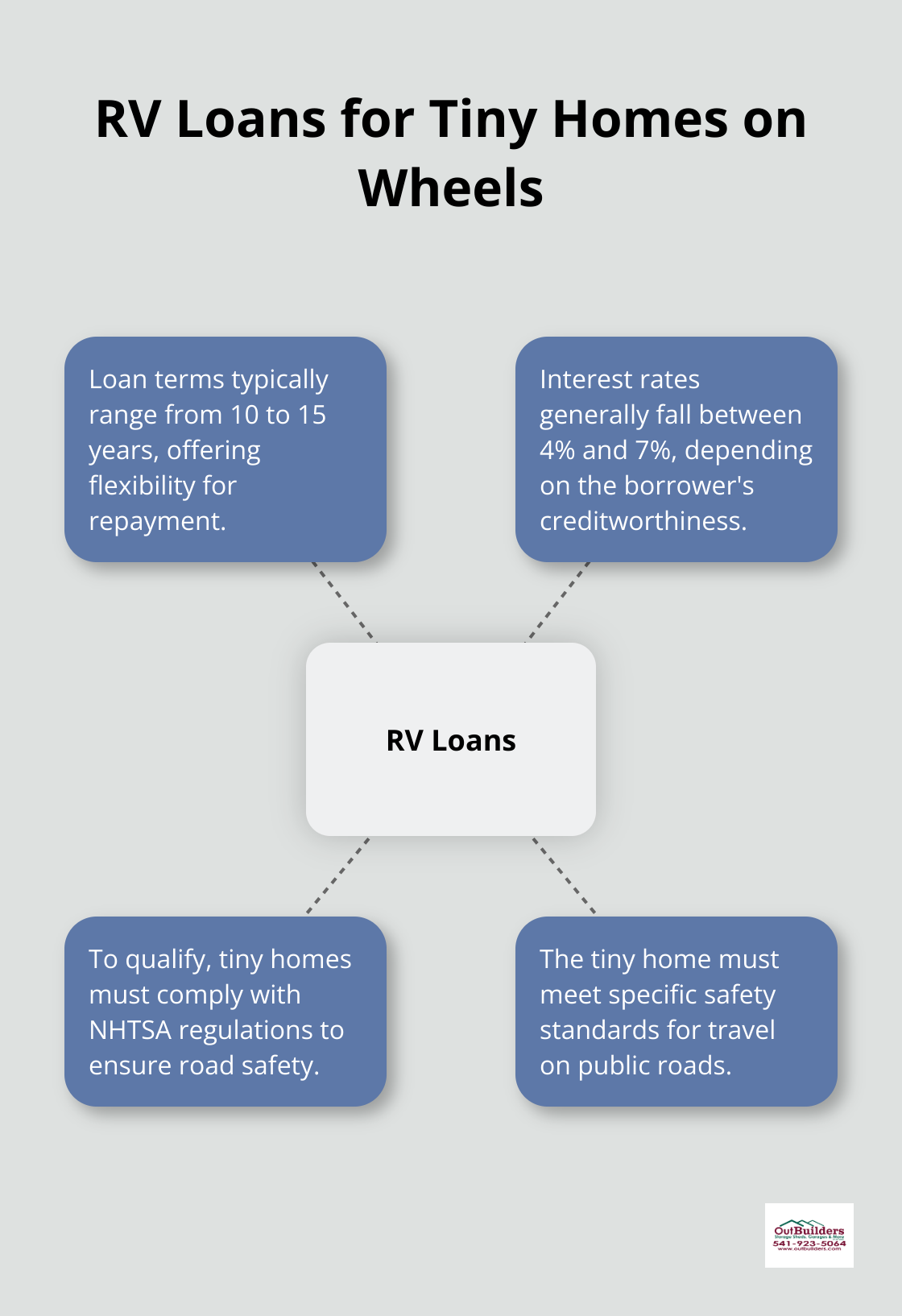

For tiny homes on wheels, RV loans offer a viable option. These loans typically feature 10-15 year terms with interest rates ranging from 4-7%. To qualify, your tiny home must comply with NHTSA regulations and meet specific safety standards for road travel.

Personal Loans: Quick but Costly

Personal loans for tiny homes often serve as the primary choice for financing. These loans don’t require collateral and have easier qualification processes. However, they come with higher interest rates (usually between 6-36%, depending on your credit score) and shorter repayment terms (typically 2-7 years).

Tiny Home-Specific Lenders

Some lenders specialize in tiny home financing, understanding the unique aspects of tiny home ownership. For example, LightStream offers unsecured loans specifically for tiny homes with loan amounts from $5,000 to $100,000. These specialized lenders often provide more favorable terms for tiny home buyers.

Crowdfunding: A Modern Approach

Platforms like GoFundMe have become a creative financing option for tiny home projects. This approach works particularly well for those with compelling stories or unique designs.

Financing represents just one aspect of the tiny home journey. The next crucial step involves saving and budgeting for your dream tiny home, which we’ll explore in the following section.

How to Save and Budget for Your Tiny Home

Set Clear Financial Goals

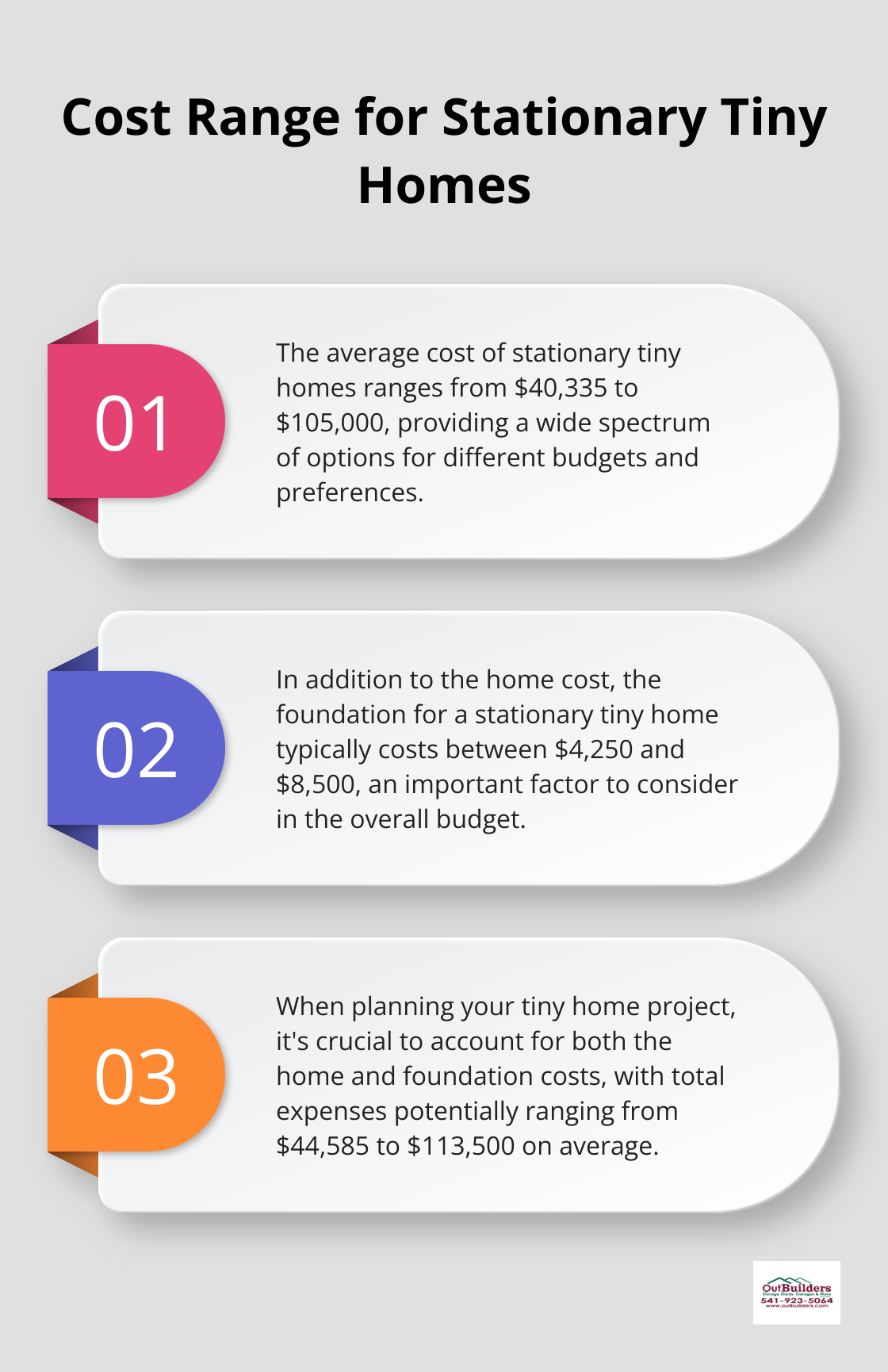

Determine the total cost of your tiny home project. Include the home itself, land (if applicable), and any additional features or customizations. Stationary tiny homes cost an average of $40,335 to $105,000, with the foundation costing $4,250 to $8,500. After you have a target figure, break it down into monthly savings goals.

Trim Your Current Expenses

Find areas where you can cut back on spending. Cancel unused subscriptions, reduce dining out, and consider downsizing your current living situation. Many tiny home enthusiasts report saving hundreds of dollars monthly by making these changes.

Explore Additional Income Streams

Take on a side job or freelance work to boost your savings. The gig economy offers numerous opportunities. For instance, full-time Uber drivers (40+ hours per week) can earn up to $50,000+ annually.

Choose Your Building Method Wisely

The choice between DIY and professional build significantly impacts your budget. While DIY can save money upfront, it often leads to unexpected costs and delays. Professional builds ensure quality and efficiency.

Cut Costs During Construction

If you choose the DIY route, source materials carefully. Look for reclaimed materials or discounted items. Some tiny home builders have reported savings of up to 50% on materials through careful sourcing and timing of purchases.

Consider Financing Options Carefully

While saving is ideal, financing can help you achieve your tiny home dream faster. Compare interest rates and terms from different lenders. A lower monthly payment over a longer term might cost more in the long run due to interest.

Saving and budgeting for a tiny home takes discipline, but it’s achievable with the right approach. Now that you’ve learned how to save and budget for your tiny home, let’s explore some creative financing solutions that can help make your dream a reality.

Innovative Financing for Your Tiny Home

Crowdfunding Your Tiny Home

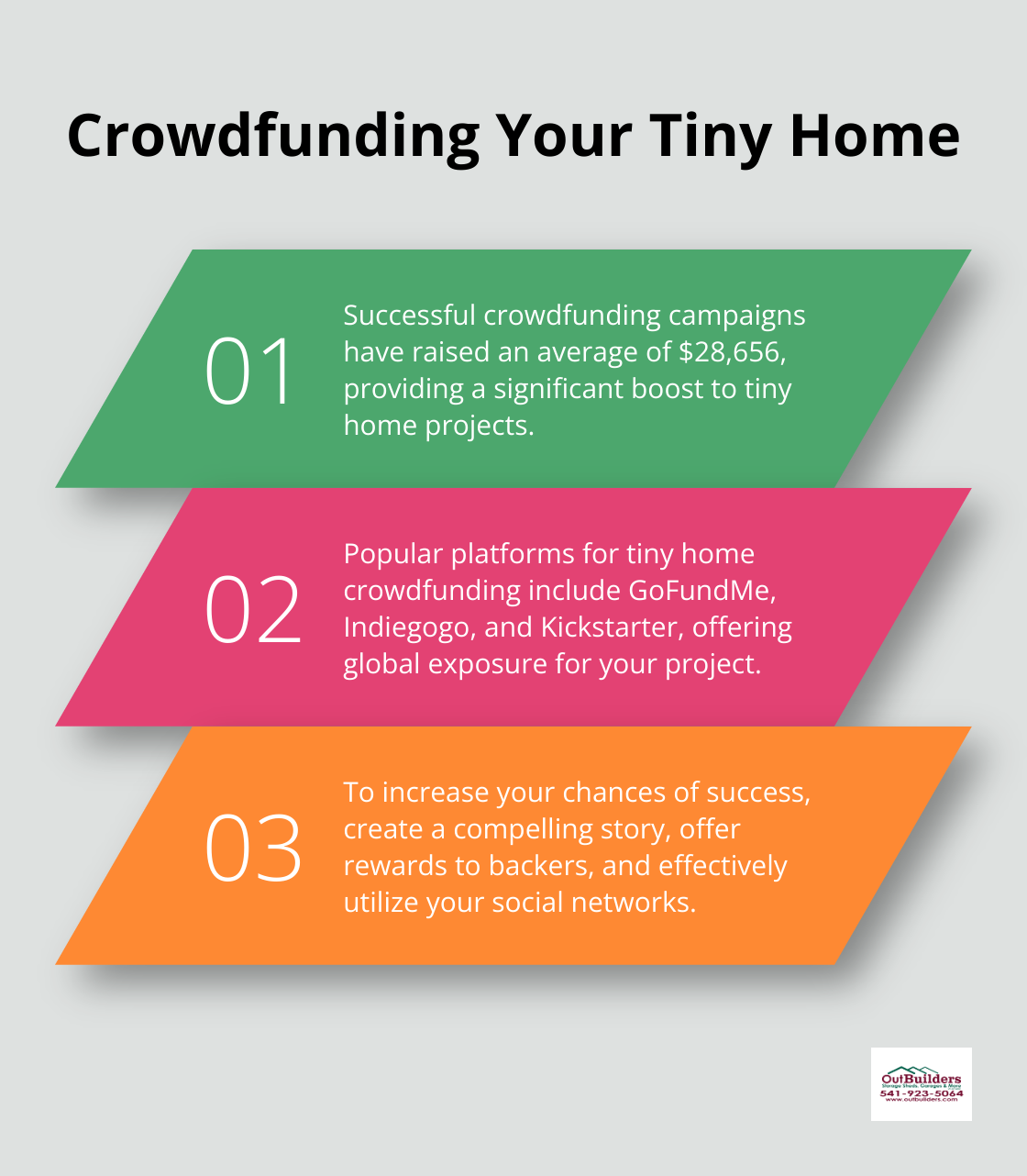

Crowdfunding platforms offer a modern approach to finance tiny homes. Websites like GoFundMe, Indiegogo, and Kickstarter allow you to present your tiny home vision to a global audience. Successful crowdfunding campaigns have raised $28,656 on average. To increase your success chances, create a compelling story, offer rewards to backers, and use your social networks effectively.

Peer-to-Peer Lending Networks

Peer-to-peer (P2P) lending platforms connect borrowers directly with individual lenders, often providing more flexible terms than traditional banks. These loans can suit tiny home financing well, especially for those with good credit scores.

Rent-to-Own Programs

Some tiny home builders provide rent-to-own programs, enabling you to live in your tiny home while paying towards ownership. These programs typically require a 10-20% down payment of the home’s value. Interest rates may exceed traditional mortgages, but they offer a path to ownership for those who might not qualify for conventional loans.

Specialized Tiny Home Lenders

A growing number of lenders recognize the tiny home market. These specialized lenders often understand the unique aspects of tiny home ownership better and may offer more favorable terms.

Government Programs and Grants

Don’t overlook potential government assistance. The U.S. Department of Agriculture’s Single Family Housing Direct Home Loans program offers loans for low-income individuals in rural areas (which could apply to tiny homes). Some states also have grants available for affordable housing initiatives that might include tiny homes.

Final Thoughts

Financing a tiny home requires creativity and careful planning. We explored various options, from traditional mortgages to innovative solutions like crowdfunding and peer-to-peer lending. Each method has its advantages and disadvantages, and the best choice depends on your unique situation.

The future of tiny home financing looks promising. As the tiny house movement grows, more lenders recognize the need for specialized loan products. We expect to see more flexible financing options and potentially even government-backed programs specifically for tiny homes in the coming years.

At Outbuilders, we understand the unique challenges of tiny home living. Our team is ready to discuss how our products can complement your tiny home lifestyle, helping you maximize space and functionality in your new compact dwelling. You can finance a tiny home through various methods, and with proper research and planning, you’ll find a solution that fits your needs and budget.

Recent Comments